Similar to most legal proceedings, filing for Bankruptcy in Las Vegas follows a precise timeline; specific requirements must also be followed to ensure a smooth bankruptcy filing. At Half Price Lawyers, our experienced, trusted attorneys have taken the confusion and stress out of filing for bankruptcy. We’re here to help guide you through the bankruptcy process, clearly and kindly.

During a Free Consultation, we’ll look over the specifics of your case and discuss the best possible options for you and your family. Whether you’re filing for a Chapter 13 bankruptcy or a Chapter 7 bankruptcy, we’re here to help relieve you of the anxiety that has likely built up in your life due to this financial hardship.

Until then, here is some important information about Nevada’s bankruptcy timeline and deadlines.

Your Chapter 7 or Chapter 13 bankruptcy case officially beings when one of our Half Price Lawyers attorneys files your bankruptcy petition with the court in Southern Nevada.

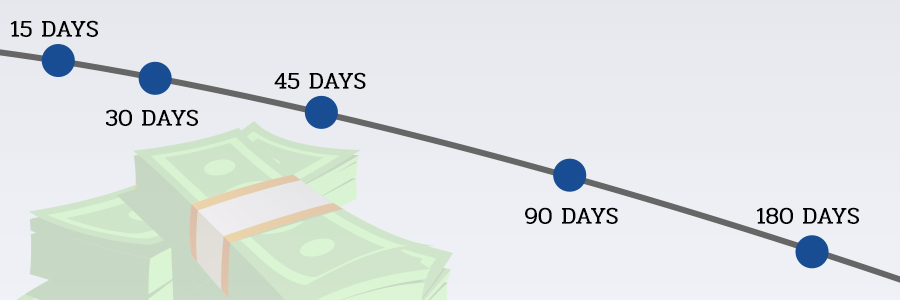

You have 15 days after the petition is filed to provide the bankruptcy court with information about your assets, expenses, liabilities, income, and other vital information to your case. For a Chapter 13 bankruptcy, you must additionally file your repayment plan during this time. Don’t feel overwhelmed; we’re here to help you gather all of the relevant information and put it together in the best way possible to support your case.

The required documents we will collect from you include:

At this point, an impartial Bankruptcy Court trustee is appointed to administer your case. This trustee will evaluate your case as serve as a disbursing agent (collecting payments from you and distributing them to your creditors so you will no longer have any contact between you and your creditors.) This relieves you from harassment by creditors. As well, anyone who co-signed a loan with you—whether it be personal, family, or for household purposes, will stop being harassed as well.

After approximately 45 days (post initial filing) your Meeting of Creditors/341 Hearing takes place in bankruptcy court. Both you and your Half Price Lawyer attorney will need to be present at this meeting, which will take place in front of the bankruptcy trustee. During this meeting, you will be placed under oath, and both the trustee and creditors have the right to ask you questions. However, oftentimes, no creditors come to the meeting.

If you filed as a joint petition with your spouse, you must both attend the creditors’ meeting and answer questions. The purpose of the meeting is to resolve any problems with the repayment plan. After this meeting concludes, your Half Price Lawyers attorneys will go to a confirmation hearing on your behalf; it is at this meeting that your repayment plan is approved.

The last step is the Discharge of your bankruptcy, once the payment plan is complete.

Proof of claim from government agencies have a 180-day deadline. What this means is: government agencies that have claims against you (i.e. taxes owed to the IRS) will have 180 days after the date of your initial petition to submit proof of their claims against you.

Additional Notes about Filing for Bankruptcy in Las Vegas

180 Days Before Filing: You must undergo training from a Certified Credit Counseling agency before being eligible to file for bankruptcy in the state of Nevada. See us for details.

90 Days Before Filing: You must be a resident in Nevada for at least 90 days before filling within a Nevada bankruptcy court.